The Strategic Impact of Russia’s Stock Market Rally Amid Geopolitical Tensions in July 2025

On July 14, 2025, the Moscow Exchange (MOEX) Russia Index surged by approximately 2.7%, marking one of the most significant one-day gains in recent months. This spike came in the wake of public statements by then-President Donald Trump, which seemingly signaled a potential thaw in trade relations involving Russia. The market’s positive reaction highlights the intricate link between geopolitical developments and investor sentiment in Russia's equities, underscoring a possible strategic reallocation of global capital flows.

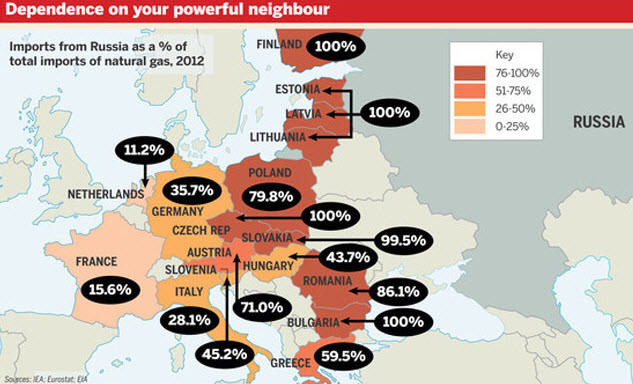

Figure 1: Europe's energy dependence on Russian gas remains a pivotal factor influencing geopolitical and market dynamics.

Market Drivers: Geopolitics as a Catalyst

The 2.7% rally on the MOEX Russia Index was largely driven by renewed optimism that some trade restrictions on Russia could ease or that economic cooperation might expand, reducing the pervasive geopolitical risk premium that had long constrained Russian asset valuations. President Trump’s remarks, which hinted at a more conciliatory stance on trade with Russian partners, helped recalibrate market expectations.

In the context of persistent global uncertainty, these developments temporarily reduced fears of further sanctions or economic isolation, prompting investors to re-engage with Russian equities.

This shift unfolded amid broader global supply chain challenges and complex geopolitical fault lines, where Russia remains a key player due to its energy exports and strategic geopolitical position.

Sector Contributions: Focus on Energy, Materials, and Financials

The rally was not uniform across the board but was mainly concentrated in three core sectors, each with unique sensitivities to external factors:

Energy Sector

Russia’s energy companies benefited from relatively stable oil and natural gas prices amid ongoing global supply uncertainties. With European dependence on Russian natural gas still significant despite diversification efforts, companies in this sector saw a rebound on hopes that trade cooperation might stabilize supply chains and reduce sanctions-related disruptions.

Materials Sector

The materials sector, encompassing metals and mining firms, gained traction fueled by rising global demand for raw materials. Russia’s prominent position as a major exporter of nickel, palladium, and other critical metals positions the sector as a bellwether for international industrial activity. Market participants interpreted geopolitical easing as a potential lever for smoother export flows and improved commodity pricing.

Financial Sector

Financial stocks rallied on expectations of improved capital inflows and the possibility of relaxed financial sanctions. Russian banks and financial institutions, historically hampered by limited access to international capital markets, benefited from the prospect of regulatory easing, which would enhance liquidity and credit availability in the domestic economy.

Figure 2: Trading activity on the Moscow Exchange surged amid renewed geopolitical optimism.

Global Investment Implications: Navigating Opportunities and Risks

The MOEX rally presents a compelling case study for global investors weighing emerging market exposure amid geopolitical complexities.

Opportunities:

- Enhanced Returns: Russia’s unique macroeconomic drivers, especially in commodities and energy, can bolster portfolio returns, particularly when global supply-demand imbalances support commodity prices.

- Diversification: Russia’s market dynamics often deviate from Western markets due to distinct geopolitical and economic fundamentals, offering diversification benefits within emerging and frontier market allocations.

Risks:

- Geopolitical Uncertainties: Despite recent optimism, Russia remains exposed to cyclical risks from sanctions, diplomatic shifts, and military tensions that can abruptly reverse market gains.

- Currency Volatility: The Russian ruble’s susceptibility to fluctuating oil prices and geopolitical developments introduces foreign exchange risk that can exacerbate portfolio volatility.

- Regulatory Environment: The opaque regulatory and legal framework in Russia requires investors to maintain heightened due diligence and risk controls.

Strategic Recommendations for Investors

Given the complex interplay of risks and rewards illustrated by the July 2025 rally, investors should consider the following strategies:

1. Tactical Portfolio Diversification

Selective and calibrated exposure to Russian equities within emerging market or frontier market funds can help capture upside potential while limiting concentration risk. Investors might prefer ETFs or mutual funds with active management focusing on liquidity and sector balance.

2. Robust Risk Controls and Hedging

Deploy currency hedges to mitigate ruble volatility and consider geopolitical risk insurance products where available. Utilizing stop-loss orders and dynamic position sizing can also alleviate downside risk during market reversals.

3. Ongoing Monitoring of Geopolitical Developments

Active surveillance of international diplomatic relations, sanctions regimes, and trade policy changes is essential. Investors should stay informed through reputable sources and adapt strategies as new information emerges.

Figure 3: Russia’s materials sector remains a critical component of its export economy and a key beneficiary of shifting geopolitical dynamics.

Conclusion: A Cautious Yet Opportunistic Outlook

The 2.7% rally in the Russian stock market on July 14, 2025, serves as a stark reminder of how geopolitical narratives remain a dominant force shaping market trajectories in geopolitically-sensitive markets like Russia. For investors with a high-risk appetite and a strategic horizon, selective participation in Russian equities could provide meaningful diversification and return enhancement amidst a shifting global trade environment.

However, the persistent volatility and regulatory opacity call for disciplined risk management, vigilant monitoring, and a cautious allocation approach. The evolving interplay between geopolitical developments and commodity market fundamentals will continue to dictate Russia’s market performance in the near to medium term.

References:

Keywords: Russia, MOEX, Russian stock market, geopolitical risk, emerging markets, portfolio diversification, energy sector, materials sector, financials, trade relations