Impact of US 93.5% Tariffs on Non-Chinese Graphite Producers: Market Reactions and Investment Implications

The US government's recent imposition of a staggering 93.5% tariff on graphite imports originating from China has sent ripples across the global battery materials market in mid-2025. As graphite remains a critical raw material for lithium-ion batteries powering electric vehicles (EVs) and renewable energy storage, this trade policy shift is reshaping supply chains, investor sentiment, and competitive dynamics worldwide.

Battery production increasingly dependent on secure graphite supply chains (Source: ImpoMag)

Overview: Strategic Tariffs in a Critical Minerals Landscape

China accounts for an estimated 70% to 80% of the world’s natural graphite supply, dominating both mining and processing capacity. This dominance has long posed strategic concerns for governments aiming to secure critical minerals essential for the energy transition.

The US Department of Commerce’s decision to enforce a 93.5% tariff on Chinese graphite imports reflects an aggressive protectionist stance aimed at reducing dependency on geopolitical rivals and encouraging domestic and allied graphite production. This move aligns with broader US efforts to secure supply chains for electric batteries, semiconductors, and other strategic technologies.

Market Reaction: Surge in Non-Chinese Graphite Producer Shares

The immediate market response has been pronounced. Shares of non-Chinese graphite producers, particularly those with operations in Canada, Brazil, Mozambique, and other emerging supply regions, have rallied sharply since the tariff announcement.

According to the Financial Times, investor optimism centers on the anticipation of increased demand and market share for these alternative suppliers as battery and EV manufacturers seek to diversify their input sources.

For example, Canadian producers like Northern Graphite Corporation (TSX: NGC) and Nouveau Monde Graphite (TSX: NMG) saw shares climb between 15% to 25% in the days following the tariff enforcement. Similar upward momentum was noted in Brazilian and Mozambican graphite juniors with expansion plans.

Canadian graphite mine expanding capacity amid global supply shifts (Source: GraphiteHub)

Supply Chain and Industry Implications

Supply Diversification and Strategic Realignment

Battery manufacturers and EV OEMs are accelerating efforts to secure graphite from non-Chinese sources. This shift is driven by:

- Reduced cost competitiveness of Chinese graphite due to tariffs, prompting buyers to consider higher-cost but politically safer alternatives.

- Government incentives and trade agreements encouraging mining and processing investments in allied countries.

- Growing environmental and social governance (ESG) scrutiny on supply chains, benefiting producers with strong sustainability credentials outside China.

Countries like Canada, Brazil, and Mozambique, endowed with substantial natural graphite deposits, are ramping up exploration and capacity development. In parallel, downstream processing capabilities are increasingly prioritized to add value and reduce reliance on Chinese beneficiation.

Investment in Capacity Expansion

Non-Chinese producers are leveraging improved capital inflows to expand mining and processing infrastructure. Strategic partnerships between mining companies, battery manufacturers, and governments are facilitating large-scale projects designed to fill the supply gap created by tariffs.

For instance, Nouveau Monde Graphite recently secured funding to build a fully integrated graphite processing plant in Quebec, aiming to serve North American battery supply chains. Similarly, Mozambique’s graphite mining sector is attracting international investment to upgrade extraction and export capabilities.

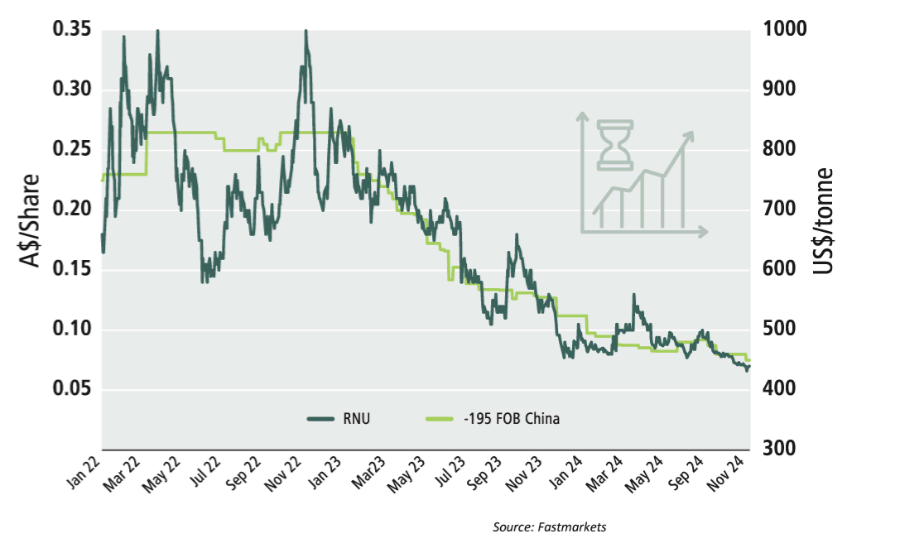

Price Dynamics: Winners and Losers

The tariff artificially inflates the cost of Chinese graphite, pushing global prices upward. While this benefits non-Chinese producers, it also increases input costs for battery manufacturers, potentially compressing margins or slowing adoption if cost inflation is passed downstream.

Industry analysts forecast graphite prices to remain elevated in the near term, with possible volatility as market participants adjust sourcing strategies. The potential for price spikes underscores the importance of supply chain resilience and strategic inventory management.

.png)

Critical minerals supply chain highlighting graphite's role (Source: Natural Resources Canada)

Investment Considerations for Market Participants

Thematic Exposure

Investors looking to capitalize on this paradigm shift may consider:

- Equity positions in graphite producers and processors outside China with solid fundamentals and growth pipelines.

- Thematic ETFs focused on battery materials and critical minerals, which provide diversified exposure to the broader energy transition supply chain.

- Private equity and infrastructure funds targeting graphite mining and processing projects in politically stable jurisdictions.

Risk Factors

Despite the upside, investors must be mindful of:

- Potential retaliatory tariffs or trade disputes from China that could escalate supply chain disruptions or trigger price wars.

- Regulatory uncertainties affecting mining approvals, environmental compliance, and export controls in emerging supply regions.

- Technological shifts, including advances in synthetic graphite substitutes or battery chemistries reducing graphite demand.

- Volatility in commodity prices due to macroeconomic factors including inflation, currency fluctuations, and global demand cycles.

Fundamental and Liquidity Analysis

Thorough due diligence on producer balance sheets, capital expenditure plans, and operational execution is vital. Investors should prioritize companies with:

- Robust project pipelines and scalable production.

- Strong ESG practices mitigating regulatory and reputational risks.

- Adequate liquidity or access to capital to sustain expansion amid market fluctuations.

Conclusion: A New Competitive Landscape for Graphite

The US imposition of a 93.5% tariff on Chinese graphite imports marks a significant inflection point in the global battery materials market. It accelerates supply chain diversification, supports capacity expansion outside China, and elevates graphite prices globally.

For investors, the evolving landscape presents compelling opportunities to gain thematic exposure to critical minerals underpinning the energy transition. However, success demands vigilant monitoring of geopolitical developments, supply chain adjustments, and technological innovations.

As battery and EV industries intensify production to meet climate goals, securing reliable, politically sound graphite supply will remain paramount. The tariff reshapes the competitive dynamics—rewarding nimble producers and investors who can navigate this complex, fast-changing market.

Graphite is a critical raw material in lithium-ion battery anodes (Source: Financial Times)

References

- Shares in non-Chinese graphite producers rally after US unveils 93.5% tariff – Financial Times

- Natural Resources Canada, Critical Minerals Value Chain (2025)

- GraphiteHub, Canadian Graphite Mining News (2024)

Keywords: graphite, tariffs, battery materials, supply chain, EV, trade policy, critical minerals, investment

Date: July 18, 2025