Mid-2025 Fixed Income Market Outlook: Catastrophe Bonds, Emerging Market Corporates, and Liquidity Dynamics

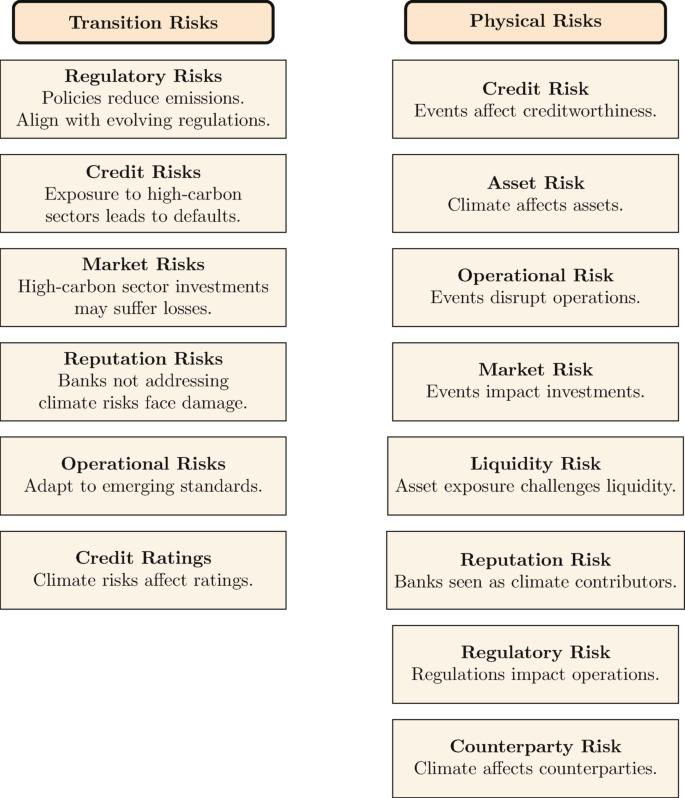

As markets navigate a complex macroeconomic landscape in mid-2025, the fixed income space reveals evolving dynamics shaped by climate risks, geopolitical shifts, regulatory integration, and investor demand for yield and diversification. This analysis explores four pivotal areas redefining fixed income portfolios: record catastrophe bond issuance, emerging market corporate bonds, global fixed income liquidity amid regulatory reforms, and the rapidly expanding sustainable debt market.

Source: SpringerNature - Catastrophe bond market growth and diversification trends

Catastrophe Bonds: Record Issuance and Risk-Return Evolution

In the first half of 2025, catastrophe bonds—securities transferring natural disaster risk to capital markets—achieved unprecedented issuance levels. GC Securities, the investment banking arm of Guy Carpenter, played a key role in structuring a record number of deals amid rising insured catastrophe losses globally. Notably, Allstate reported a hefty $1.99 billion pre-tax catastrophe loss in Q2 2025 alone, underscoring insurers’ need for capital market risk transfer.

This surge reflects expanding investor appetite for alternative fixed income assets that deliver attractive yields and low correlation to traditional markets. Despite a gradual compression from peak yields seen in mid-2023, catastrophe bonds continue to offer yields exceeding 10% in U.S. dollars, according to Franklin Templeton’s latest commentary. Their appeal lies in portfolio diversification benefits and risk-adjusted returns resilient to economic cycles.

However, risk-return profiles within the cat bond universe are diverging. Industry-loss triggered bonds have seen faster declines in return per unit risk compared to parametric and modelled-loss triggered bonds. This divergence, supported by Man Group data, signals increased market sophistication and the critical importance of due diligence on trigger designs and catastrophe modeling. Investors are advised to carefully evaluate bond triggers and event probabilities to optimize risk exposure.

Franklin Templeton maintains a strongly overweight stance on catastrophe bonds for Q3 2025, signifying confidence in their role as a strategic fixed income diversifier amid macro uncertainty.

Emerging Market Corporate Bonds: Yield Opportunities and Risk Management

Emerging market (EM) corporate bonds are a focal point for yield-seeking investors amid persistently low global interest rates and moderate inflation. These bonds typically offer significant yield premiums over developed market credits, driven by growth prospects in commodity-exporting economies and increasing institutional demand for income and diversification.

Data from leading asset managers like Invesco and Federated Hermes highlight the importance of geographic and sectoral diversification within EM corporates. Active credit selection, focusing on issuers with robust balance sheets and resilient cash flows, remains crucial in mitigating elevated credit and liquidity risks. Investors should also tactically adjust portfolio duration to respond to evolving interest rate environments.

Currency risk, a key consideration in EM debt, requires nuanced hedging approaches depending on cost, currency outlook, and investor risk appetite. With ESG factors gaining prominence, integrating sustainability criteria into credit evaluation is increasingly standard, aligning with regulatory trends and institutional mandates.

EM corporate bonds thus present compelling risk-adjusted return opportunities, contingent on disciplined risk management and active portfolio oversight.

Global Fixed Income Liquidity: Market Volatility and Regulatory Integration

The fixed income market’s liquidity landscape faces headwinds in mid-2025. U.S. Treasury rates trading volumes contracted approximately 7% from May to June 2025 as investors adopt a cautious stance amid uncertain Federal Reserve policy and evolving inflation expectations.

Amid this volatility, regulatory initiatives are reshaping liquidity and market access, notably the People’s Bank of China’s Interim Measures for Mutual Bond Market Access between Mainland China and Hong Kong SAR. This landmark framework enables qualified investors to trade bonds cross-border, expanding the investor base and enhancing secondary market activity.

By facilitating deeper integration, this measure is expected to tighten spreads and improve benchmark pricing for sovereign and corporate bonds in the region. While emerging market debt liquidity remains vulnerable during global risk-off episodes, the China-Hong Kong model could serve as a template for similar market access programs in other emerging economies, fostering deeper, more resilient fixed income markets.

Source: Elsevier - Market liquidity trends in global fixed income

Sustainable Debt Market Surpasses USD 6 Trillion: Investor Implications

The sustainable debt market, comprising green, social, sustainability, and sustainability-linked bonds (collectively GSS+), crossed a milestone of over USD 6 trillion outstanding in mid-2025, more than tripling since early 2024. This exponential growth is driven by institutional investor momentum, enhanced regulatory frameworks such as the EU Sustainable Finance Taxonomy, and a market environment favoring diversification amid volatility.

Sustainable bonds offer differentiated portfolio benefits. Their typically lower correlation with conventional bonds improves diversification and resilience in turbulent markets. However, investors must apply rigorous due diligence on bond frameworks, certifications, and impact reporting to mitigate greenwashing risks and ensure alignment with sustainability objectives.

Looking ahead, strong issuance growth is expected to continue, underscoring the need for strategic portfolio integration—both through core broad-based sustainable bond funds and thematic satellite allocations targeting sectors like renewable energy and social infrastructure.

Strategic Takeaways for Fixed Income Investors

- Diversify across fixed income segments. Combining catastrophe bonds, emerging market corporates, and sustainable debt can optimize yield while managing portfolio risk.

- Conduct rigorous credit and trigger analysis. Especially vital for catastrophe bonds and EM corporates to understand event trigger structures and credit resilience.

- Monitor evolving regulatory developments. Programs like China-Hong Kong bond market integration influence liquidity and access, impacting fixed income valuations.

- Integrate ESG considerations. Align portfolios with rising investor mandates and regulatory expectations to enhance risk management and capture growth themes.

- Leverage liquid instruments. ETFs and other liquid vehicles enable tactical exposure and efficient liquidity management amid volatile markets.

By embracing a proactive, research-driven approach, investors can successfully navigate the mid-2025 fixed income environment, balancing emerging opportunities with complex risks.

Source: Climate Bonds Initiative - Growth trajectory of global sustainable debt

References

- GC Securities Record Cat Bond Issuance, Artemis

- Franklin Templeton Cat Bonds Commentary, Artemis

- Invesco Emerging Market Corporate Bond Fund

- Federated Hermes Emerging Market Debt Strategies

- People’s Bank of China Interim Measures

- MarketWatch U.S. 10 Year Treasury Note

- Climate Bonds Initiative Sustainable Debt Market

Published July 18, 2025