Navigating the Trump Crypto Ecosystem: Regulatory Implications and Market Dynamics in Mid-2025

Cryptocurrency market dynamics increasingly influenced by political figures and regulatory shifts. (Source: Reuters)

In mid-2025, the cryptocurrency landscape is intricately intertwined with political influence, regulatory evolution, and emerging market products. Former U.S. President Donald Trump’s expanding footprint in the crypto sector has become a focal point for investors, regulators, and industry observers alike. From the passage of the bipartisan GENIUS Act regulating stablecoins, to Trump Media & Technology Group’s filing of a pioneering Crypto Blue Chip ETF, and controversies surrounding Trump-branded crypto ventures, these developments collectively shape market sentiment and policy trajectories.

This analysis delves into the regulatory frameworks, market reactions, and the risks and opportunities confronting investors as they navigate the complex nexus of politics and digital assets in 2025.

The Regulatory Landscape: GENIUS Act and Political Nuances

The U.S. Senate’s passage of the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins) represents a landmark regulatory milestone aiming to provide guardrails for the burgeoning stablecoin market. Stablecoins, cryptocurrencies pegged largely to the U.S. dollar, have surged toward a potential $3.7 trillion market by decade’s end, according to Treasury estimates.

While the legislation garnered bipartisan support, it notably excludes the President and his immediate family from restrictions on profiting from stablecoin ventures. This gap has drawn sharp criticism from Democrats and consumer advocates, who warn it creates regulatory loopholes potentially exploited by Trump’s crypto empire.

Senator Tim Scott (R-S.C.), Chair of the Senate Banking Committee, hailed the bill as “the most significant digital assets legislation ever to pass the U.S. Senate,” emphasizing its bipartisan craftsmanship. Yet, Senator Elizabeth Warren lamented that the legislation failed to “rein in the President’s crypto corruption,” underscoring political tensions underlying the bill’s passage.

The GENIUS Act aims to regulate stablecoins but exempts the President and family from certain restrictions, fueling political debate. (Source: The Hindu)

The bill prohibits members of Congress and their families from profiting directly through stablecoins but stops short of extending that ban to the White House occupants. This regulatory asymmetry augments scrutiny on Trump’s multiple crypto-linked holdings, including the $TRUMP memecoin and World Liberty Financial’s USD1 stablecoin.

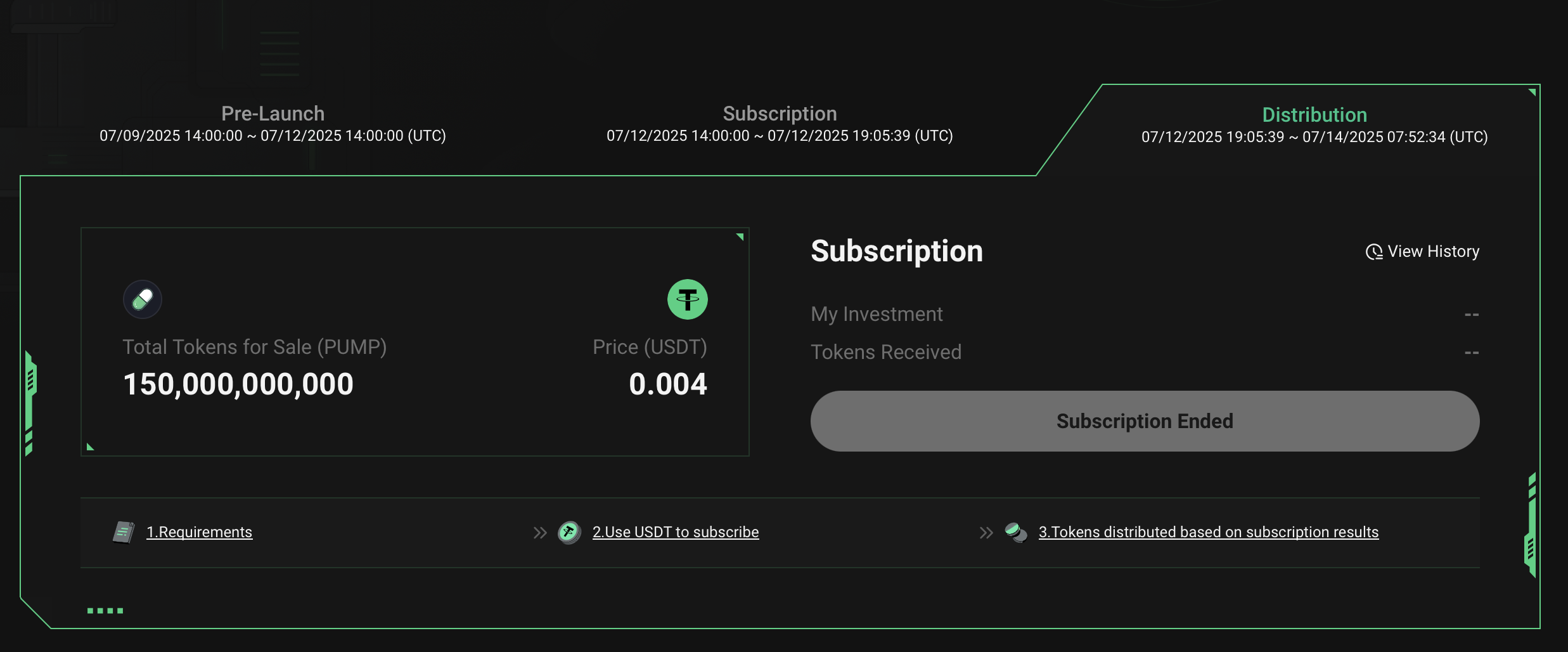

Trump Media’s Crypto Blue Chip ETF: Institutionalizing Crypto Exposure

In a strategic move to capitalize on growing institutional and retail demand for regulated crypto investment vehicles, Trump Media & Technology Group (TMTG) filed with the Securities and Exchange Commission (SEC) for approval of the Crypto Blue Chip ETF. The ETF proposes a diversified portfolio weighted heavily toward major cryptocurrencies:

- 70% Bitcoin (BTC)

- 15% Ether (ETH)

- 8% Solana (SOL)

- 5% Ripple (XRP)

- 2% Crypto.com’s native token (CRO)

Crypto.com will serve as the digital custodian for the fund, underscoring the increasing role of trusted custodianship in enhancing investor confidence.

This ETF filing aligns with broader market trends favoring regulated crypto funds that provide exposure without direct cryptocurrency ownership, mitigating custody risks and complexity for investors. Since the debut of Bitcoin ETFs in the U.S. last year, crypto-based ETFs have witnessed accelerating adoption, offering potential liquidity enhancements and mainstream validation.

Trump Media’s Crypto Blue Chip ETF seeks SEC approval to offer diversified crypto exposure. (Source: The Hindu)

Industry experts note that the ETF could serve as a gateway for conservative institutional investors wary of direct crypto market volatility, while also augmenting retail participation via regulated channels.

Impact on Market Sentiment and Investor Behavior

Trump's high-profile engagement with crypto—ranging from launching the $TRUMP memecoin to hosting exclusive investor galas—has generated a spectrum of reactions, from bullish enthusiasm to cautious skepticism.

On the optimistic side, many investors and industry insiders appreciate Trump’s crypto-friendly regulatory stance, which has facilitated the rollback of aggressive enforcement actions initiated under the prior Biden administration. Coinbase CEO Brian Armstrong publicly praised Trump’s early regulatory moves, and crypto donations played a pivotal role in fueling Trump’s 2024 campaign efforts.

Notably, prominent crypto entrepreneur Justin Sun, founder of TRON, emerged as a top investor in Trump-linked ventures, committing over $90 million across multiple projects, according to blockchain analytics. Sun’s involvement adds institutional credibility but also invites scrutiny given ongoing regulatory probes into his market activities.

However, the intertwining of political influence and crypto business raises concerns around governance and transparency. Critics argue that Trump’s active promotion of crypto projects may expose markets to manipulation risks and undermine efforts to establish credible, fair regulatory standards.

The recent trend of deepfake videos and AI-driven scams exploiting Trump’s image further complicates investor trust. Security experts highlight an increasing prevalence of frauds deploying sophisticated AI chatbots and fake video endorsements that impersonate Trump, deceiving unsophisticated investors and amplifying risks of capital loss.

AI-driven scams leveraging deepfake technology have surged, exploiting Trump’s name to defraud crypto investors. (Source: Reuters)

Risks and Opportunities for Global Investors

Regulatory Ambiguity and Enforcement Gaps

Despite the GENIUS Act’s passage, enforcement mechanisms remain nascent, and political exemptions create uncertainty. The failure to address Trump’s personal crypto holdings leaves unresolved questions on conflict of interest and regulatory impartiality. Investors must remain vigilant as regulatory interpretations and enforcement priorities evolve.

Market Volatility Tied to Political Events

Trump-branded crypto assets have demonstrated substantial price swings correlated with political developments, public appearances, and social media announcements. Such volatility amplifies investment risk, demanding sophisticated risk management and timing strategies.

Institutional Adoption and Market Maturation

The proposed Crypto Blue Chip ETF signals growing institutional acceptance of digital assets. Regulated investment products can improve liquidity and price discovery, potentially stabilizing markets over the medium term.

Fraud and Scam Proliferation

The confluence of Trump’s high profile and crypto’s susceptibility to fraud has emboldened scammers employing AI-generated deepfakes and sophisticated social engineering. Investors must prioritize due diligence, leverage regulatory guidance, and adopt robust security practices.

Conclusion: Balancing Innovation, Regulation, and Political Influence

The cryptocurrency ecosystem in 2025 stands at an inflection point where political influence, regulatory initiatives, and market innovation converge. Donald Trump’s active engagement in crypto ventures underscores both the sector’s mainstream ascendancy and the attendant complexities in governance.

For investors, understanding the evolving regulatory framework such as the GENIUS Act, monitoring the trajectory of institutional products like the Crypto Blue Chip ETF, and navigating the risks posed by political entanglements and fraud are critical for informed decision-making.

As the U.S. aspires to cement itself as a global crypto hub, the challenge remains to foster innovation while ensuring market integrity, transparency, and consumer protection. The Trump crypto phenomenon encapsulates this dynamic tension, providing a unique lens through which to assess the future of digital assets.

References

- Trump Media files for ’Crypto Blue Chip ETF’ with SEC - The Hindu

- U.S. Senate passes stablecoin bill in milestone for crypto industry - The Hindu

- Trump hosts gala for crypto memecoin buyers despite corruption concerns - The Hindu

- AI chatbots, deepfake software, and fake ID generators help automate crypto scams: Report - The Hindu

- U.S. Senate advances legislation to regulate stablecoins, a form of cryptocurrency - The Hindu

Author’s note: This article aims to provide a comprehensive and objective market analysis on the current political and regulatory factors shaping the U.S. cryptocurrency market in mid-2025. Investors should consult professional advisors before making investment decisions.