U.S. House Passes Landmark Stablecoin Regulatory Bill Amid Bipartisan Debate

The U.S. Capitol building, where the House passed the GENIUS Act on July 17, 2025.

Source: Twitter/@USHouseNews

On July 17, 2025, the U.S. House of Representatives approved the GENIUS Act by a 308-122 vote, marking a watershed moment in the regulation of cryptocurrencies, and stablecoins in particular. This legislation, having previously cleared the Senate with bipartisan backing, establishes the first comprehensive regulatory framework specifically tailored to stablecoins—digital assets pegged to stable instruments such as the U.S. dollar that aim to minimize price volatility inherent in broader cryptocurrency markets.

The GENIUS Act’s passage signals Washington’s intent to provide regulatory clarity, foster innovation, and protect consumers within the rapidly evolving digital asset ecosystem. However, despite broad support, the bill has sparked controversy over concerns about regulatory rigor and potential conflicts of interest linked to former President Donald Trump’s financial ties to the crypto industry.

Defining New Ground for Stablecoins and Digital Assets

The GENIUS Act introduces several critical provisions designed to bring structure and oversight to the stablecoin market:

-

Regulatory Oversight and Compliance:

The bill mandates that stablecoin issuers adhere to established anti-money laundering (AML) and sanctions regulations, aligning digital asset governance with traditional financial safeguards. This is a notable shift from the prior regulatory ambiguity that left many crypto firms navigating a patchwork of enforcement actions rather than clear rules. -

Digital Asset Classification:

Importantly, the legislation delineates digital assets into two categories:- Commodities overseen by the Commodity Futures Trading Commission (CFTC), including mature cryptocurrencies such as Bitcoin and Ethereum.

- Securities regulated by the Securities and Exchange Commission (SEC), a distinction critical for enforcement and investor protections.

-

CBDC Ban:

In a separate but related legislative victory, Congress narrowly passed a bill prohibiting the U.S. government from issuing a central bank digital currency (CBDC), reflecting concerns around monetary sovereignty and privacy.

These components provide the foundational guardrails that many in the crypto industry have long sought to facilitate mainstream adoption and operational certainty.

Industry and Political Perspectives

The crypto sector greeted the GENIUS Act as a historic advancement. Patrick McHenry, vice chair of Ondo Finance and former chair of the House Financial Services Committee, hailed the legislation as “massive generational impact,” likening it to the 1930s securities laws that helped shape modern Wall Street.

“These bills will make the United States the center of the world for digital assets,” McHenry stated, emphasizing the potential for the U.S. to lead global crypto regulation and innovation.

Yet, the bill’s scope has not gone unchallenged. Democratic lawmakers expressed reservations about the legislation’s perceived leniency. Senator Elizabeth Warren, ranking member of the Senate Banking Committee, criticized the bill for insufficient consumer protections and national security considerations. Some Democrats voiced concern that the framework could enable large corporations to issue private cryptocurrencies with limited oversight, thereby increasing systemic financial risks.

Moreover, critics pointed to potential conflicts of interest involving former President Trump, who reportedly has personal financial stakes in crypto ventures. Representative Jim Himes publicly opposed the bill, stating:

“I cannot in good faith vote to advance a bill that allows Donald Trump to continue grifting off the American people through cryptocurrency schemes.”

This contention highlighted broader worries about political influence intersecting with regulatory governance in the digital asset space.

Legislative Negotiations and Next Steps

The bill's final passage came after a brief conservative revolt threatened to stall proceedings. Some Republican holdouts delayed the vote over policy disputes, particularly regarding the CBDC ban. An agreement to attach the CBDC prohibition to the must-pass annual Pentagon policy bill helped secure their eventual support.

With House approval complete, the GENIUS Act now awaits President Trump’s signature to become law. Simultaneously, House Republicans are pushing the Senate to advance a companion bill aimed at further clarifying the regulatory framework for digital assets, underscoring the ongoing legislative momentum in this sector.

Implications for Investors and the Crypto Ecosystem

The enactment of the GENIUS Act represents a fundamental shift in U.S. crypto policy, balancing the dual imperatives of fostering innovation and safeguarding investors. By defining regulatory jurisdictions and imposing AML compliance, the bill reduces the legal uncertainty that has long impeded crypto companies and institutional adoption in the U.S.

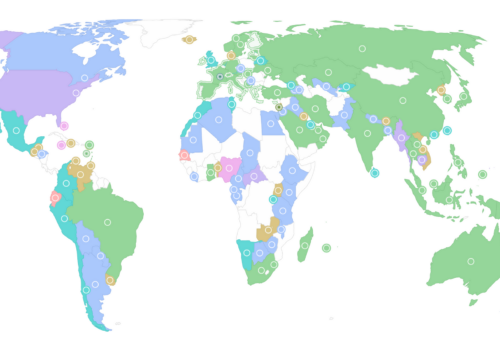

Stablecoins themselves constitute a rapidly growing segment within digital assets. According to market data, stablecoins represent a significant portion of the overall crypto market capitalization, serving as vital conduits for liquidity and fiat onramps.

Stablecoins hold a growing share of the cryptocurrency market as of mid-2025.

Source: Public Flourish

However, the debate over regulatory sufficiency and political entanglements highlights the fragile balance policymakers must maintain. Ensuring that regulations are robust enough to prevent fraud, protect consumers, and preserve financial stability — without stifling innovation — remains a delicate task.

Conclusion

The U.S. House’s passage of the GENIUS Act is a landmark milestone that sets the stage for the country to become a global leader in stablecoin and digital asset regulation. By providing clear legal definitions, compliance mandates, and consumer protections, the bill addresses longstanding industry calls for clarity and legitimacy.

Nevertheless, the polarized political environment and concerns over regulatory weaknesses and conflicts of interest underscore the challenges ahead. As the bill moves to the White House, all eyes will be on whether it can deliver on its promise of fostering a secure yet dynamic crypto ecosystem.

References

- WDIO News: House Votes on Trio of Cryptocurrency Bills

- CNN Politics: GENIUS Act Passes House

- Financial Times: Crypto Regulation

- NBC Washington Facebook: Stablecoin Bill Approval

Author’s Note: This article reflects market and political developments as of July 17, 2025, and will be updated as the legislative process continues.