The Hidden Concentration Risks in Popular ETFs: Implications for Global Investors in 2025

Exchange-Traded Funds (ETFs) have long been celebrated as efficient tools for cost-effective diversification and market exposure. By 2025, their adoption has skyrocketed among retail and institutional investors alike, forming the backbone of numerous global portfolios. However, beneath this veneer of simplicity lies a more complex reality: many widely held ETFs carry significant concentration risks that can undermine diversification objectives and potentially amplify portfolio volatility.

This article delves into the structural concentration within popular ETFs, explores the impact of their weighting methodologies on risk profiles, and offers strategic insights for global investors seeking to optimize ETF allocations amid evolving market dynamics.

Concentration Dynamics in the 2025 ETF Landscape

Market concentration has tightened considerably over recent years, particularly within broad-based equity ETFs tracking major indices such as the S&P 500. The phenomenon stems primarily from the prevalence of market-capitalization weighting schemes, which allocate portfolio weights proportional to company size. This mechanism naturally inflates the influence of mega-cap companies, many of which are clustered in the technology and growth sectors.

According to Piper Sandler’s Chief Strategist Michael Kantrowitz, “Because there are concentration issues and weighting schemes in these ETFs, you think you're buying something and it's actually not what you're getting.” This warning resonates amid a backdrop where the top 10 constituents of flagship ETFs such as the Fidelity 500 Index Fund (FXAIX) or the SPDR Portfolio S&P 500 ETF (SPLG) can represent upwards of 25-30% of total assets.

This concentration skews the risk-return dynamics of the ETFs, leading to several notable effects:

- Tracking Error Risks: ETFs heavily exposed to a handful of mega-cap stocks can deviate materially from the broader market’s performance, especially when these dominant stocks behave idiosyncratically.

- Sector Overweights: Sector-specific ETFs may not achieve true diversification if a few dominant companies disproportionately drive returns. For example, technology sector ETFs may be disproportionately influenced by leading tech giants.

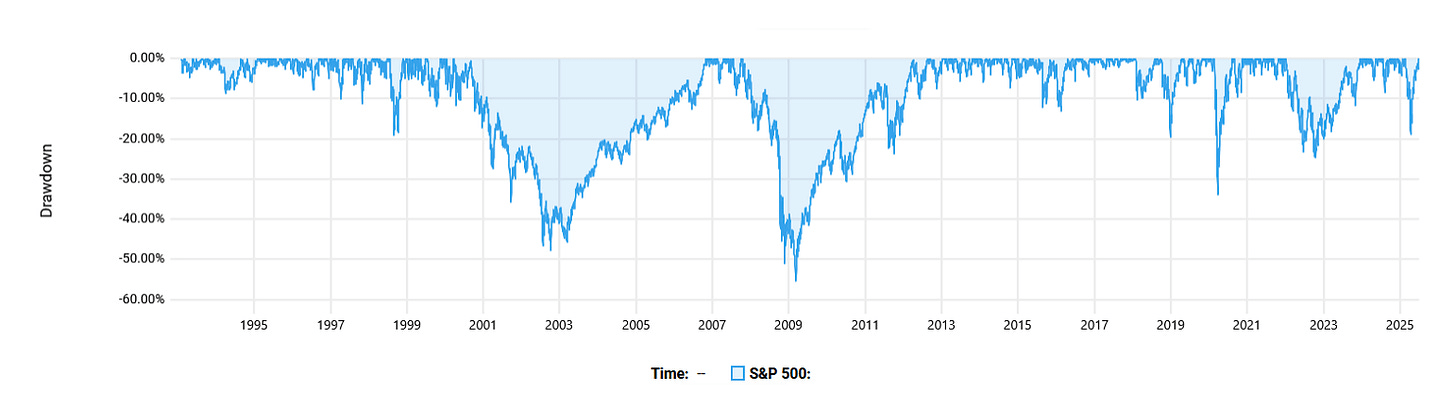

- Volatility Amplification: Concentrated holdings can exacerbate portfolio volatility during market downturns, as a correction in a few large-cap stocks exerts outsized impact on the ETF’s NAV.

The structural concentration is not confined to U.S. markets. Regional and thematic ETFs in Asia-Pacific and emerging markets exhibit similar patterns, where a limited number of companies dominate market capitalization and liquidity. This amplifies idiosyncratic risk, challenging the assumption that broad index exposure automatically ensures diversification.

The Impact of Weighting Schemes on ETF Concentration

Traditional ETFs predominantly employ market-cap weighting because of its simplicity and scalability. However, this approach inherently magnifies the exposure to the largest constituents, potentially leading to unintended portfolio tilts.

Alternative weighting schemes have emerged to address these challenges:

- Equal Weighting: Allocates the same weight to each constituent, reducing mega-cap dominance but increasing turnover and transaction costs.

- Fundamental Weighting: Weights companies based on financial metrics such as earnings, book value, or dividends, aiming to anchor exposure to economic fundamentals.

- Factor-Based Weighting: Uses systematic factors like value, quality, momentum, or low volatility to diversify and potentially enhance risk-adjusted returns.

These methodologies can mitigate concentration risks by distributing portfolio weights more evenly and reducing reliance on a few dominant stocks. However, each approach carries trade-offs regarding turnover, tracking error, and exposure to different market risks.

Implications for Global Investors

For global investors, the hidden concentration risks in popular ETFs pose significant challenges:

- Idiosyncratic Risk Exposure: Investors may unintentionally concentrate risk in a small subset of companies or sectors, which can undermine portfolio resilience, especially during market shocks.

- Overreliance on Passive Strategies: Solely relying on traditional passive ETFs may leave portfolios vulnerable to systemic shifts affecting mega-cap stocks.

- Regional Concentration: Regional ETFs often reflect local market structures marked by dominant companies, e.g., China’s Alibaba and Tencent in Asian indices, exacerbating concentration concerns.

- Portfolio Misalignment: The assumption that owning multiple ETFs equates to broad diversification may be misleading if the underlying holdings overlap significantly.

These factors necessitate a critical reassessment of ETF allocations to ensure alignment with investors' risk management and diversification goals.

Strategic Guidance for Optimizing ETF Allocations

1. Blend Passive ETFs With Active Management

Incorporating actively managed mutual funds or actively managed ETFs can provide a counterbalance to concentration risks inherent in cap-weighted passive funds. Active managers can adjust exposures based on fundamental analysis, reduce overweight positions in dominant stocks, and navigate valuation extremes.

Michael Kantrowitz advises investors to "lean more into active management, including ETFs and mutual funds, as well as individual stock picks," to mitigate concentration-driven risks.

2. Diversify Across Factors and Regions

Factor-based ETFs that emphasize value, quality, momentum, or low volatility offer a means to diversify away from mega-cap growth dominance. Combining these with geographically diversified ETFs helps reduce localized concentration and sector biases.

For instance, blending U.S.-focused ETFs with exposure to emerging markets or Europe can spread risk across varying economic cycles and market structures.

3. Monitor ETF Holdings Regularly

Investors should conduct ongoing reviews of the top holdings and sector weights within their ETFs. Tools provided by Morningstar, ETF providers, or financial platforms can facilitate transparency and enable timely portfolio adjustments.

4. Complement ETFs With Select Individual Securities

Augmenting ETF exposure with selective individual stock investments allows investors to fine-tune portfolio risk more granularly and avoid overexposure to dominant ETF holdings.

Conclusion

ETFs remain invaluable components of modern portfolios, offering liquidity, cost efficiency, and accessibility. However, global investors in 2025 must recognize that popular ETFs, especially those following conventional cap-weighted indices, often harbor significant concentration risks that can compromise diversification and amplify volatility.

A sophisticated approach blending passive and active strategies, incorporating factor diversification, geographic breadth, and continuous portfolio oversight is essential to navigate these hidden risks. As market dynamics evolve and concentration pressures persist, investors equipped with deeper insight and strategic flexibility will be better positioned to safeguard returns and achieve true diversification.

References

- Business Insider, "Your ETF investment might be dragging down your portfolio returns — here's why," July 19, 2025. Read more

Investors should regularly assess ETF concentration metrics to understand portfolio risks.

Diversification strategies incorporating active management can mitigate concentration risks in ETFs.

Author: [Your Name], Financial Markets Analyst

Date: July 19, 2025