Navigating the Fixed Income Landscape: Strategies Amidst Rising Yields

As bond markets fluctuate amidst the backdrop of rising interest rates, investors face a critical juncture where adapting strategies has never been more paramount. With the 10-year U.S. Treasury yield recently hovering between 4% and 4.5%, the implications for fixed income investments are profound. This article delves into the current yield environment, explores the challenges and opportunities presented by increasing yields, and offers actionable insights for optimizing bond portfolios.

Understanding the Current Yield Environment

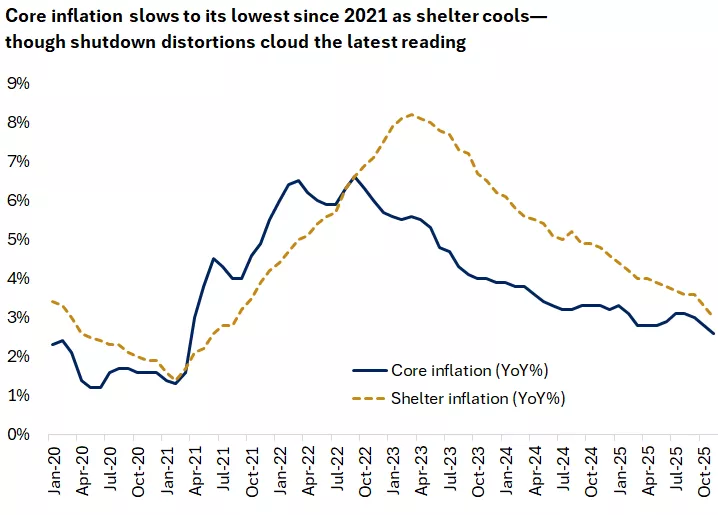

The past few months have witnessed significant movements in bond yields, particularly driven by monetary policy signals and economic forecasts. The Federal Reserve's ongoing adjustments to interest rates, aimed at curtailing inflation, have directly influenced the fixed income landscape. As yields climb, existing bondholders may experience capital losses; however, new investors can find attractive entry points as they look for stable income sources.

Why It Matters

Higher yields present a dual-edged sword. For current bondholders, rising interest rates typically lead to falling bond prices, creating a precarious situation where the value of their investments diminishes. Conversely, for new market entrants, these elevated yields signify a shift towards more favorable conditions for income generation. As the Federal Reserve has hinted at potential rate cuts in 2026, the widening rate advantage between bonds and cash could make bonds increasingly appealing for buyers seeking reliable income streams.

Strategic Adjustments for Investors

Navigating this evolving landscape requires strategic foresight. Here are several key strategies for managing fixed income investments amidst rising yields:

-

Reassess Duration Exposure: Investors should maintain a benchmark-neutral duration in their bond portfolios. This approach helps mitigate interest rate risk while still allowing participants to capitalize on yield opportunities.

-

Diversify Bond Holdings: Incorporating a mix of high-quality corporate bonds and government securities can improve yield while providing stability against market volatility. A diversified portfolio can help absorb shocks from fluctuating interest rates and economic conditions.

-

Monitor Economic Indicators: Keeping a close eye on inflation trends and economic growth forecasts is crucial. Analysts predict that as inflation stabilizes and economic conditions improve, bond yields could stabilize, presenting new opportunities for investment.

Conclusion

As the fixed income landscape continues to evolve, investors must remain agile and informed. By adjusting strategies, focusing on quality bonds, and staying abreast of market trends, they can effectively navigate this complex environment. The potential for increased returns amidst rising yields creates a critical opportunity for investors to reassess their bond market positions.

Investors are encouraged to consult financial advisors to tailor their investment strategies accordingly. The right adjustments can enhance portfolio performance, ensuring that fixed income investments remain resilient and profitable amidst changing market dynamics.

For further insights into the fixed income market, resources such as Edward Jones and MarketWatch can provide valuable information to help investors make informed decisions.