The Impact of Rising U.S. Treasury Yields on Fixed Income Strategies

As U.S. Treasury yields hover between 4% and 4.5%, investors in fixed income markets are prompted to reevaluate their strategies to optimize returns against the backdrop of rising interest rates. With the current landscape presenting both challenges and opportunities, understanding the implications of yield fluctuations is paramount for bond investors.

Understanding the Current Yield Landscape

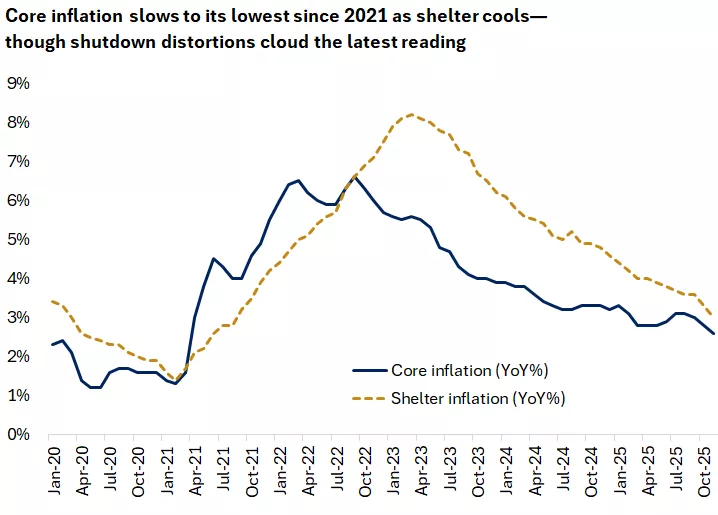

The recent uptick in U.S. Treasury yields has reverberated throughout fixed income markets, especially for the 10-year note, which is often seen as a benchmark for determining borrowing costs across various financial instruments. These yields, currently fluctuating significantly, are indicative of broader market dynamics influenced by inflation fears and potential shifts in monetary policy.

Key Considerations for Investors

In light of these conditions, investors should take into account several critical factors:

-

Duration Exposure: With rising yields, longer-duration bonds face the risk of price declines. Investors should reassess their exposure and consider incorporating shorter-duration bonds into their portfolios, which are generally less sensitive to interest rate fluctuations.

-

Diversification: A diversified bond portfolio can help mitigate risks associated with interest rate changes. Investors are encouraged to explore a mix of government, municipal, and corporate bonds to achieve an optimal balance between risk and return.

-

Economic Indicators: Keeping an eye on key economic metrics, including inflation trends and employment data, is crucial. These factors can significantly influence future interest rate movements, thus affecting bond prices.

Strategic Recommendations

As bond investors navigate this evolving landscape, they should consider the following strategic recommendations:

-

Maintain Benchmark Neutral Duration: Keeping a duration that is neutral to the benchmark helps manage interest rate risks effectively. This strategy can provide a cushion against price volatility as yields fluctuate.

-

Consider High-Quality Bonds: In periods of market uncertainty, high-quality bonds offer stability and a reliable income stream, making them an appealing choice for risk-averse investors.

-

Evaluate Cash Allocations: With cash yields likely to stabilize, investors might consider reallocating some cash into high-quality bonds or equities to boost overall portfolio performance. This strategic reallocation can be crucial in enhancing investment returns amidst changing market conditions.

Conclusion

The current environment of rising U.S. Treasury yields presents a complex landscape for fixed income investors. By adapting their strategies to focus on duration, diversification, and economic indicators, investors can better position themselves to navigate these challenges successfully. With careful planning and informed decision-making, there are opportunities to be seized even in a fluctuating yield environment.

For additional insights into market conditions and investment strategies, you can explore Edward Jones’ Market Update.

In conclusion, maintaining an adaptable and informed approach, particularly in the context of rising yields, will be paramount for successful fixed income investing in the coming months. Investors are encouraged to stay proactive in reviewing their portfolios and making adjustments as market dynamics evolve.