The Shift in Fixed Income: How Canadian Government Bond Yields are Influencing Global Markets

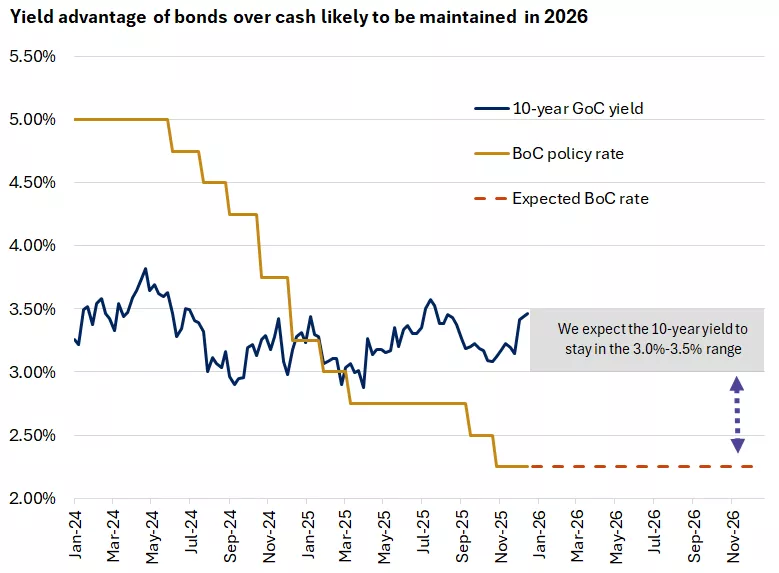

In the last few weeks, Canadian government bond yields have approached the upper limits of their post-2008 range, currently fluctuating between 3% and 3.5%. This development is significant, as it offers potential income opportunities for investors who are reevaluating their fixed income strategies in light of a global environment characterized by fluctuating interest rates. As the Bank of Canada (BoC) maintains a steady rate, the implications of this trend extend well beyond Canada’s borders, impacting global markets and investor behaviors across the United States and Europe.

Why It Matters

The current yield environment in Canada is particularly compelling for income-seeking investors. With the BoC projected to keep interest rates stable, the yield differential between cash and bonds remains attractive. According to recent analyses, this stability suggests that investors should consider maintaining a slightly above-benchmark duration for their bond portfolios. As cash yields are expected to decline gradually, there is a growing incentive to explore alternative asset allocations.

Investors may contemplate increasing their exposure to high-quality bonds or equities, depending on their individual risk tolerance and investment objectives. The rationale behind this shift is rooted in optimizing returns in a changing economic landscape. As noted by portfolio managers, "The market is signaling that higher yields in Canadian bonds could redefine how global investors approach their fixed income allocations" (Edward Jones, 2025).

Global Implications

The ramifications of Canadian bond yield movements are far-reaching. As global economies grapple with rising interest rates and inflationary pressures, Canadian yields may influence investor behavior in other regions. The U.S. and European markets are particularly susceptible to these shifts, especially considering the parallel trends in their respective interest rates.

For instance, if Canadian yields maintain their current levels into 2026, it could lead to notable shifts in capital flows. As higher yields in Canada attract foreign investment, this could place upward pressure on bond prices in other markets as investors seek comparable returns. Analysts from the Bank of Canada have indicated that "the stability of Canadian bond yields plays a critical role in the broader global financial landscape" (Bank of Canada, 2025).

Moreover, the interconnectedness of global financial markets means that a surge in Canadian yields may prompt adjustments in interest rate expectations elsewhere. Investors in the U.S. and Europe should be diligent in monitoring how these Canadian trends may affect their own fixed income strategies.

Analyzing the Canadian Yield Landscape

Canadian government bond yields have historically been volatile, influenced by both domestic fiscal policy and international economic conditions. As of late 2025, the yields are notable for being near their highest levels since the financial crisis of 2008. This rise is driven by several factors:

-

Economic Recovery Post-COVID-19: The Canadian economy's recovery trajectory has been stronger than anticipated, leading to adjustments in interest rate expectations.

-

Inflationary Pressures: With inflation rates hovering above the Bank of Canada’s target, there is an ongoing dialogue regarding future monetary policy and its implications for bond yields.

-

Global Demand for Yield: As investors worldwide seek refuge in quality assets, Canadian bonds have become an attractive option due to their relatively high yields compared to other developed markets.

Investment Strategies Moving Forward

For investors navigating this evolving fixed income landscape, several strategies may be prudent:

-

Duration Management: Given the current interest rate outlook, maintaining a slightly above-benchmark duration for bond exposure can enhance returns, especially if yields stabilize or continue to rise.

-

Diversification: Investors should consider diversifying their portfolios to include a mix of high-quality bonds and equities. This approach can mitigate risks, particularly in a potentially volatile market environment.

-

Monitoring Cash Yields: With cash yields projected to decline, it may be beneficial for investors to reassess any cash holdings. Utilizing this capital toward higher-yielding bonds or equities may offer better returns in the long run.

Conclusion

The current state of Canadian government bond yields presents a unique opportunity for investors worldwide to reevaluate their fixed income strategies. By understanding the broader implications of these trends, particularly in the context of rising interest rates and global economic interconnectedness, investors can better position their portfolios for future market dynamics. As capital flows adapt to these changing yields, the fixed income landscape will likely continue to evolve, offering both challenges and opportunities for astute investors.

Investors should remain vigilant and informed, as developments in Canadian bond yields are likely to play a critical role in shaping global investment strategies in the coming months.

For further insights and updates on market conditions, investors can refer to Edward Jones' Weekly Market Update.