The Rise of Layer 2 Solutions: Transforming Crypto Transactions

In the fast-paced arena of cryptocurrency, the efficiency of transactions is paramount. Major networks such as Bitcoin and Ethereum have garnered criticism for their elevated fees and sluggish processing times, particularly during periods of high demand. As the cryptocurrency landscape matures, Layer 2 solutions are emerging as a pivotal innovation, addressing these challenges and heralding a new era of scalability and accessibility in digital finance.

What Are Layer 2 Solutions?

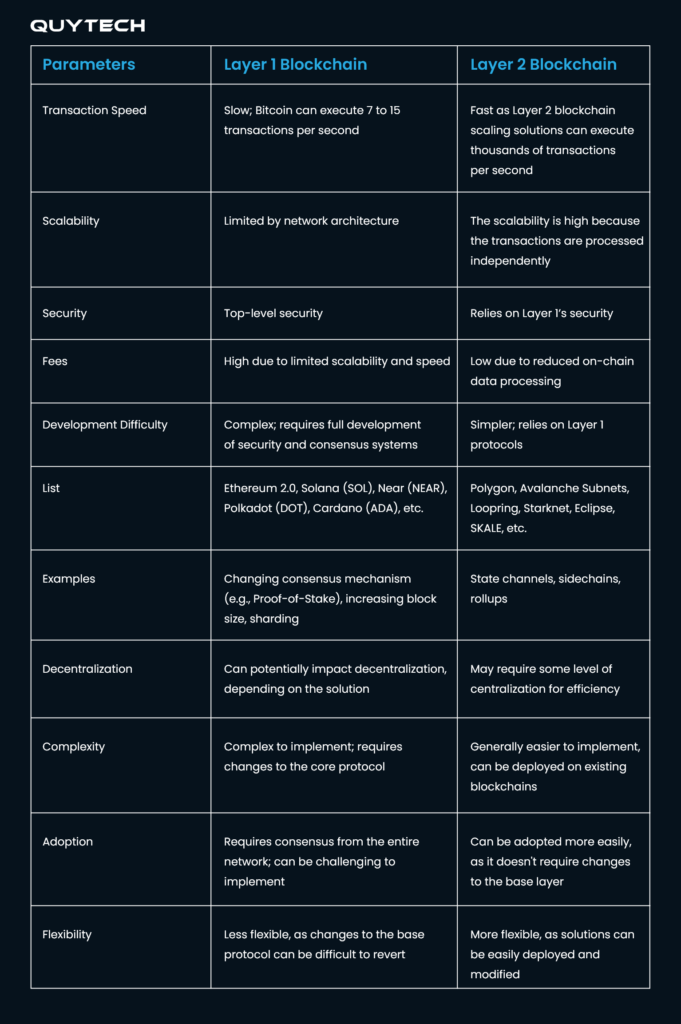

Layer 2 solutions refer to secondary frameworks built atop existing blockchain networks (Layer 1), aimed at improving transaction efficiency. By processing transactions off the main blockchain before settling them back, these solutions significantly enhance speed and reduce costs. Notable examples include the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum, both designed to alleviate congestion and offer a more user-friendly experience.

Key Features of Layer 2 Solutions

-

Cost Efficiency: With traditional transaction fees often soaring during market peaks, Layer 2 solutions dramatically lower costs, making cryptocurrencies more accessible to average users. This encourages broader adoption and use in everyday transactions.

-

Increased Scalability: Layer 2 technologies can handle a higher volume of transactions per second. For instance, Ethereum’s capacity has historically been limited by its proof-of-work consensus mechanism; however, with the introduction of Layer 2 solutions, it can potentially process thousands of transactions in seconds, fostering a vibrant ecosystem for decentralized applications (dApps).

-

Enhanced User Experience: By offering faster transaction times and lower fees, Layer 2 solutions facilitate a smoother user experience. This is essential for attracting new users and retaining existing ones, particularly in competitive scenarios where user experience plays a crucial role.

-

Market Dynamics: As Layer 2 solutions gain traction, they are expected to shift the competitive landscape among cryptocurrencies, influencing investment strategies and creating new opportunities for developers and investors alike.

Current Trends and Future Outlook

Recent developments indicate a burgeoning interest in Layer 2 technologies, evidenced by significant investments flowing into related projects. Polygon (MATIC), for instance, has gained widespread attention for its ability to enhance Ethereum's scalability. This has resulted in increased usage and adoption of dApps on its platform, showcasing the functionality and potential of Layer 2 solutions.

The Growing Investment Landscape

Investors are beginning to recognize Layer 2 solutions as a crucial component of the cryptocurrency ecosystem. According to a report by CoinDesk, funding for Layer 2 projects reached over $2 billion in the past year, underscoring a significant shift in market sentiment. As the market grows increasingly competitive, the ability to process transactions efficiently will serve as a decisive factor that could determine the success or failure of various blockchain projects.

![]()

Real-World Applications and Benefits

Layer 2 solutions are not solely theoretical; they are already making a tangible impact. For example, the Lightning Network has successfully facilitated millions of transactions, enhancing Bitcoin's usability for microtransactions. This is particularly important for businesses seeking to accept Bitcoin as a form of payment, as it lowers costs and decreases transaction times.

On the Ethereum side, Optimistic Rollups are transforming how developers build decentralized applications. By enabling cheaper and faster transactions, they allow for more complex applications that can handle a wider array of use cases, from gaming to finance. This advancement could lead to a renaissance in decentralized finance (DeFi), where innovative financial products emerge to meet consumer demands.

Why It Matters for Investors

For investors, the rise of Layer 2 solutions presents several compelling opportunities:

-

Access to New Markets: As transaction costs decrease, more users may enter the market, thereby expanding the overall user base for cryptocurrencies. This potential increase in adoption can drive demand and potentially impact prices favorably.

-

Diversification of Investment: Layer 2 solutions create new assets and tokens that investors can diversify into. For example, investing in projects like Polygon and Arbitrum can provide exposure to the growing Layer 2 ecosystem, potentially leading to significant returns.

-

Strategic Positioning: By understanding the competitive dynamics introduced by Layer 2 solutions, investors can better position themselves within the cryptocurrency market. This knowledge can help inform trading strategies and long-term investment decisions.

-

Potential for Innovation: Layer 2 solutions are at the forefront of technological innovation. Projects built with these technologies are likely to attract more developer interest, which, in turn, can lead to the creation of new applications and services that enhance the utility of cryptocurrencies.

Conclusion

The evolution of Layer 2 solutions is poised to reshape the cryptocurrency landscape, presenting myriad opportunities for investors and developers alike. As transaction costs and speeds become increasingly critical issues for major cryptocurrencies like Bitcoin and Ethereum, the importance of these technologies cannot be understated.

Investors who stay informed about these developments may find themselves at the forefront of a financial revolution, unlocking new opportunities in the ever-expanding world of digital assets. As Layer 2 solutions mature and gain widespread adoption, they promise to enhance the scalability of cryptocurrencies, paving the way for a broader acceptance of digital assets in mainstream finance.

In this rapidly evolving environment, understanding how these solutions work and their implications for the future of cryptocurrency will be crucial for anyone involved in the crypto space. Keeping an eye on the developments surrounding Layer 2 solutions will be essential for navigating the complexities of digital asset investing and maximizing returns in the years to come.